If data keeps coming out in the next week confirming that the new COVID strain is 70% more transmissible, I think the modal outcome is that ~50% of Americans will get it by the early summer. The market may take a few days to realize and react to this (as it was in March), but also just buying June put option on the SP500 seems very naïve (since the SP500 is at all-time highs and a fourth COVID wave doesn't necessarily affect much the NPV of future earning of huge corporations). So if I think that the probability of everyone getting COVID in the next six months is much likelier than the market, at least for a few days, what trade would capture that?

14 Answers sorted by

230

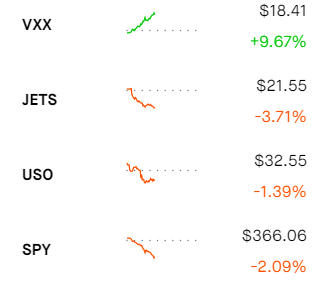

The new strain has been confirmed in the US and the vaccine rollout is still sluggish and messed up, so the above are in effect. The trades I made so far are buying out-of-the-money calls on VXX (volatility) and puts on USO (oil) and JETS (airlines) all for February-March. I'll hold until the market has a clear, COVID related drop or until these options all expire worthless and I take the cap gains write-off. And I'm HODLing all crypto although that's not particularly related to COVID. I'm not in any way confident that this is wise/useful, but people asked.

Are you tempted to drop or reduce the size of this trade in light of the UK seeming to have (roughly speaking, for now at least) contained B.1.1.7?

120

My tentative playbook/recommendations for this scenario:

Long homebuilders (ETFs: ITB, XHB; pair against short SPY if you want to be beta-neutral)

Long gold/gold miners (ETFs: GLD, GDX, GDXJ....)

This is a super difficult question. I'd be hesitant to immediately jump to long vol or flight-to-safety trades as offering the best reward-to-risk here.

Another March-style liquidity crisis seems much less likely, given we have a better understanding of COVID as a medical condition, of the nature of its economic impacts, and--perhaps most importantly--how policymakers are prone to respond.

Basically the recommended trades could do very well in an environment in which there is pressure for real interest rates to decline coupled with a Fed that is game to move to a more accommodative stance on the margin.

COVID is fundamentally a real shock and not a sharp monetary disequilibrium. People (rationally) want to defer consumption. Housing is already quite hot, as it is minimally impacted by COVID and, as the archetypal long-lived durable asset, is actually a great vehicle for people to defer consumption. If the Fed is with the market (as it would likely be), homebuilders could continue to outperform if a greater-than-expected COVID resurgence drives more on the margin to seek to defer consumption and increase real housing demand.

To first-order, gold benefits from real-interest rates declining. Fundamentally, when there is high demand to defer consumption (i.e. to save) and low-demand for investment, long-term real interest rates could (somehow) decline even futher and continue the favorable environment for gold. Yes, it has rallied quite strongly since 2019, so we'd have to be wary of chasing here. But just eyeballing the charts for this, I think there are attractive levels to add this risk on slight dip from current levels (e.g. 1820-1840ish in spot gold.

Also, the broader monetary policy reaction function is always critical to consider in my opinion. The FOMC would be more likely to extend the weighted-maturity of their asset purchases if it looks like COVID is resurging in an unexpected way. Bigger picture, they may look to make more credible commitments to overshooting 2% inflation post-COVID in order to hit their new average inflation target objective.

Obviously, a main risk I see to these trades is that these are just a continuation of COVID trades from this year (no real special view here) and we could potentially just be chasing after already-crowded trades which are prone to squeeze against us if we're wrong.

Also, the broader monetary policy reaction function is always critical to consider in my opinion. The FOMC would be more likely to extend the weighted-maturity of their asset purchases if it looks like COVID is resurging in an unexpected way.

Wouldn't this make the long long-term treasuries attractive?

120

/tldr short spring oil futures, long volatility, but this is not a sure bet.

I don't think that you can get significant expected profits from betting on devastating COVID scenario. Professional market participants are not all-knowing, but neither they are ignorant. They didn't understand that COVID is important in early 2020, but they do understand it now and they do follow the news now and they should understand what the new COVID mutations mean. It is not that difficult if you know where to look.

Don't go for the equities. Even if you assume that this information is not priced in yet, it is not that important for the equities market. Even if the economy tanks for a year and corporate profits tank for a year, everything will recover once it over and it won't make a difference for the share prices. The share price theoretically equals the sum of the lifetime profits discounted by the current risk adjusted interest rate. The risk adjusted interest rate is very low now, so profits 20 years ahead matter almost the same as profits in 2021, so yearly profits in a specific 2021 year don't matter much. Equities shouldn't tank mid-term in the scenario of COVID disaster.

Central banks and governments will compensate for the shock with expansive monetary and fiscal policies. This will bring down the interest rates even further, so asset prices should actually rise as they did in 2020, especially tech stocks, but this is a risky bet, as they might go down first due to panic.

Perhaps, your best bet is to short commodities (except gold) and oil specifically. The storage is probably filled up (please check it, I just assume that it is, but I didn't check), so the currently produced oil should be consumed now. So if there is a demand shock, the prices should drop like they did in spring. You can make use of it by shorting the oil futures with expiries when you expect the economy to be at its lowest. I guess it is in spring.

It is also a good idea to be long volatility, so you can try buying options or VIX, but options are not a good idea for a retail investor.

If the monetary and fiscal policy is aggressive and it is going to be aggressive, you can bet on interest rates going even lower and inflation going up in a few years (but not now!), so going long long-term TIPS sounds good. The issue here is that you won't be able to get a lot leverage as a retail investor and without leverage it is not worth it. If I could, I would buy long-dated TIPS options (is it even a thing?).

I don't trade and have never traded any of these markets, so please take it as a random internet opinion, not as a competent investment advice.

I do trade oil and VIX futures. This is competent advice, close to what I would have written if I'd found the time. I don't expect much reaction to this news, but if I did, I'd short March oil futures, maybe hedging by buying September oil futures.

Thank you! I’d like to keep it simple, so I’m considering some volatility ETFs, but they seem to come in the shape of short-term and mid-term futures ETFs. Which ones would you recommend for this purpose?

*

100You can assume a strong flight to safety from most market participants. Typical flight to safety trades are:

Long USD

Long Yen

Long US Treasuries (Of mid to long maturities)

Short commodities (Especially Oil)

It is important to note that in March the flight to safety was so extreme that at one point Long USD was the only positive trade.

EDIT: The trade I decided to do with regards to this situation is Long VIX out of the money calls with expiry in March 2021.

I am already long USD for quite a bit, and I think there is a decent chance the USD strengthens in the near term.

+1. I endorse the long-maturity US treasuries as a safe-haven asset. Especially if options are not an option. In a potential bear market, safe-havens are generally preferable to shorting a stock index, which is the wrong side of risk.

Everything dropped in the Corona Crash because brokers got scared and demanded more margin, so everybody had to come up with liquidity quickly. But then the treasuries recovered even faster than the stocks because of the flight to safety. That would have been a good opportunity to rebalance a stock/treasury portfolio and get t...

90

Buy VIX call options. I did that in March and made 35x on my investment.

This situation is a bit different now. In March the expected return on VIX options was very high (at least according to my calculations). Now the expected return is much lower but if you are looking for a fun high risk bet VIX calls are probably your best option. (pun intended)

It is a very risky bet, but if it works out the return is very high.

90

Back in February I had the same question one week before the market reacted. I didn't found an answer and thus didn't go for the naive instrument in time to profit. I think there's value to doing the naive thing over doing nothing.

70

Continued lockdowns will likely drive the markets higher, right? A more infectious strain might tend to increase the rate of lockdowns, even as the vaccine continues the rollout. So I would just buy-and-hold and then magically know exactly the right time to bail, when lockdowns look like they’re about to end.

Continued lockdowns will likely drive the markets higher, right?

I don't understand why this would be true. What about lots of people having to be locked down makes companies more valuable?

70

One could just wait until 'the market' (pick an ETF on your favourite index) drops by x%, buy back in (or buy calls) and cash out ~ a year or so later. This would have been a good trade in late March/early April and has a couple of pros: limited downside, relatively unsophisticated (i.e. easy to execute and plan), clear entry and exit signals. The cons are a lack of precision (I suspect a more targeted bet on e.g. vol could make more money, maybe buy the ATM straddle?), and that the low leverage.

40

Another idea, long an Israeli ETF (ITEQ) and short either the world or Europe, (VTI or VGK). They seem to be the only country on pace to immunize enough people before the wave hits.

*

20Hypothetically speaking? [This is an example of a strategy for similar situations, not investment advice. I don't know your financial situation, and I don't know what the market will do. You are responsible for your own money.] If you're expecting a crash, and vol is currently moderate, you could sell one near-the-money SPY put and use the money to buy three out-of-the-money VIX calls.

Choose the dates and strikes so that you get more premium from the put than you have to pay out for the three calls.

If you're wrong about the crash and the market continues to go up or sideways, then all the options would expire worthless and you keep the excess premium.

If the market does crash hard, the VIX will also spike hard, and you should make much more on the three VIX calls than you lose on the one SPY put, although this can depend on exactly which strikes you choose. Gains could potentially be very large in this case. But you would need to close the position before VIX falls too much. VIX spikes don't tend to last very long.

It is possible to lose some money on this spread if the market drops a just a little but not enough to push the VIX high enough to compensate. The put could then expire in the money, while the calls expire worthless. But since the market only dropped a little, your loss shouldn't be too bad.

If your put is cash-covered, this isn't much riskier than holding SPY. But if you have the ability to sell naked puts, you should know what you are doing and not leverage too high. It's possible that your broker could start to liquidate your portfolio during the crash, so watch out for margin calls.

Why not just buy a VIX call? Notice what happens if you're wrong and the market goes up or sideways when you just buy the VIX call vs the spread.

Long options are the wrong side of risk. It's a better deal in the long run to sell insurance than to buy lottery tickets, although it may not feel that way. But buying some reinsurance can be prudent.

10

I think there's some merit in looking at the medium-term aftermaths of previous stock market crashes. On average (with large variation) they show strong rises starting a year after a crash, and continuing for more than a year; with a plausible general explanation (the worst damage has been done by then and remedial measures are being taken). This may be an underlying tendency on which other specifics of the current situation are superimposed (and some will of course already be priced in).

I've just written a post with more detail & pretty graphs.

10

"I think the modal outcome is that ~50% of Americans will get it by the early summer"

What is the model for that expectation?

10

I think the secondary impact (political reactions to it) of a virus strain that is much more infectious will be much harder felt in Europe than in the US or in Asia. Because most European countries have tried to manage the infections with lockdowns and I think they will double down with longer and harder lockdowns instead of capitulating to the virus ("capitulating" is not meant in a judgemental but in a descriptive way). Given a stronger central government than in the US with its federal structure harder lockdowns are easier to accomplish there. This could heavily impact retailing, travel and leisure, driving companies into bankruptcy. So, if I had to trade those European sectors would be my primary target.

10

People getting COVID on its own won't affect large companies much. But the economy tanking because of lockdowns / people being afraid to go out most certainly will affect big companies. And the likelihood of this affecting the real economy is quite large in my opinion: (smaller) companies have been burning through their reserves, banks getting all their loans back is becoming less likely. Add another shock to the system and I wouldn't be surprised if panic hits. And given that the economy is already shell-shocked I also wouldn't be surprised if we see a larger crash than the last time around.

Add to this that stock prices don't reflect NPV perfectly, especially in the short term: "The market can stay irrational longer than you can stay solvent".

I'm still considering my possibilities but I'm thinking about liquidating a large part of my investment portfolio and taking -some- of that money to buy puts.

Of course this means having to have some idea of -when- a downturn might set in. OP mentions June, but my feeling is that this will happen much earlier and so earlier options might be in order. My thoughts are going towards buying February and / or March puts.

I have a pretty clear story line how this leads to a crash. What would need to happen for this -not- to lead to a crash?

What would need to happen for this -not- to lead to a crash?

Many investors remembering that selling in mid-March was a bad idea, and that the economy recovers from pandemics faster than most commentators expected.

Perhaps I'm missing something, but it seems like the obvious strategy is to just buy volatility-related instruments: you don't know if the market is going to go up or down, but if the new strains work anything like one would predict based on the infectiousness and the vaccine rollouts continue their shambolic slow-walk out, there will be extreme movements (even if the Fed or USG then step in) in financial instruments of all sorts.

If you can't find anyone willing to sell you bets on stability at reasonable prices, then it would seem that the general import of the strains - 'the future just got very uncertain and potentially even worse than everyone feared' - is already priced in.

VIX options, VIX futures, or ETFs based on these, such as VIXY. The VIX itself doesn't really have an underlying asset, but it's based on the implied volatility of options. Various option spreads can work, like straddle-strangle swaps, but they're harder to use if you don't know what you're doing.

Be warned, these do not move exactly like the VIX. For example, you have to pay the market a risk premium to hold VIXY, because the market pays you when it crashes. It's like buying insurance. If you think you can predict the timing of a vol spike, it's the right kind of asset to use, but over the long term, it's the wrong side of risk, and you will lose more money than you gain. Don't hold VIXY long term. I'm usually in the opposite position, SVXY, to collect that premium, but in small amounts relative to my portfolio size.

The VXX is basically at multi-year lows right now, so one of the following is true:

1. Markets think that the global economy is very calm and predictable right now.

2. I'm misunderstanding an important link between "volatility = unpredictability of world economics" and "volatility = premium on short-term SP500 options".

VXX is not a good way to compare volatility across years. VIX and similar measures are showing fairly high volatility, but no signs of new panic recently.

Calls on the VIX are extremely expensive at the moment. So perhaps some of the risk related to the strain is already priced in.

Markets can remain irrational, and inflated by monetary/fiscal policy or consumer repression, longer than your options can remain unexpired. Among other things - the real world is far more imaginative than any trader. You might as well ask, 'how did markets go up with the first coronavirus?' Better to bet on large changes through the VIX or something, rather than their exact direction & timing...

This is much less likely to catch big market players by surprise. And the factors which made the March 2020 drops less severe and less durable than expected are still in play: the big players are so tied into Government money that they can do well EVEN IF many parts of the economy fall significantly.

There's no way I know to short small, local, service companies.

I am not sure whether the probability of almost everybody getting COVID is the thing that matters most for the markets. The important question is what the reactions in different countries will be, what new or extended restrictions will be in place. I think there could be a reaction especially in leisure/travel, maybe in energy, too. I plan to sell my position in an energy ETF on monday and plan to buy back when the new virus strain and its political consequences have become obvious in a couple of weeks.

Some options and their 1-year charts:

JETS - Airline ETF

XLE - Energy and oil company ETF

AWAY - Travel tech (Expedia, Uber) ETF

Which would you buy put options on, and with what expiration?

If I were placing one of the bets I would likely bet against travel. It's recovered the most so likely has an easier drop; nice big spike in November. I would not go out too far as I think this will likely be something that has to happen sooner rather than later -- I don't think the trade is a slow burn type potential. Either you're going to see a move to say 22 quickly or options are not really a good vehicle for the trade.

I have not looked at of follow that ETF nor have I been closely following the industry. I would note a potentially unrelated item. The Philippines was planning to reopen schools in some of its provinces after the Christmas break. The administration just announce that has been suspended due to the new strain of virus. One might think similar concerns and thinking about the new strain would have an even larger impact on international travel and certainly any nonessential travel.

I have a quite bad track record with options trading, anticipating the correct direction but loosing because of wrong timing. (Therefore I will reduce the equity part of my portfolio but hopefully refrain from buying put options this time).

If I had to trade one of the three, then JETS, expiration in late March. (But I won't and this is definitely not meant as a recommendation.) I think in three months time it will be sufficiently clear for the market if the new virus strains have a heavy impact - writing from a German/European perspective where I anticipate a prolonged hard lockdown if the virus is as infectious as feared. The US reaction is much harder to anticipate for me.

I was primarily thinking about energy use for transportation falling even more than before, hitting the oil price. But I am not sure about that.

Winter is coming (hah!) which will mean more heating. That could well have been priced in already, but probably not all of it. Two potentially counteracting forces make it hard to predict what might happen. Also, -if- you're going to travel you want to do it with your own car and not with public transport so there is a story where gasoline use actually increases. Finally, aren't oil prices mostly supply driven?

So if I think that the probability of everyone getting COVID in the next six months is much likelier than the market, at least for a few days, what trade would capture that?

I suspect the first step in answering has to be what impact that increased infection is expected to produce. We should consider transmission rate and virulence. To that we need to think about the current vaccines as well.

If we see a case of significant increases in transmission rate but a reduction in virulence then I would be surprised to see a big market drop due to this (but would expect to see some lower prices in January anyhow). If we see that the new strain is protected from by the existing vaccines that holds too. We stay on the current recovery path so investment/trading plans don't really change here.

If we see a significant increase in transmission and virulence then you have to think about potentials for additional limitations on domestic and global economic activities again. Might not be unreasonable to think some of the travel/leisure companies are not going to make it so shorting that area should have a number of companies whose value goes to 0. Might also be some potential pure plays on building supplies in the HVAC area that specialize in air quality and ventilation (retail and commercial). That might be based on both people being concerned about their home systems and updated building codes to address airborne infectious pathogens such as coronavirus like this.

The inability of the existing vaccines to protect against the new strain of the virus reported from the UK would only add to the down presser and to incentives to invest in higher quality indoor air.

While I think it is very difficult to infer just what is really moving the market in most cases one might flip the question here. Given the market is doing X, what does the imply about the assessment of the health and economic impacts of the new strain of virus. Is it that much more infectious? More virulent? Do you get immunity from it via the existing vaccines or have expectations that very quick modifications and use approval exist?

One could just wait until 'the market' (pick an ETF on your favourite index) drops by x%, buy back in (or buy calls) and cash out ~ a year or so later. This would have been a good trade in late March/early April and has a couple of pros: limited downside, relatively unsophisticated (i.e. easy to execute and plan), clear entry and exit signals. The cons are a lack of precision (I suspect a more targeted bet on e.g. vol could make more money, maybe buy the ATM straddle?), and that the low leverage.